-

The value of cogeneration in decarbonising Japan

Date posted:

-

-

-

Post Author

Greg Kelsall

-

-

Cogeneration is a promising technology as part of an overall decarbonisation strategy for many countries. One such country is Japan, where CHP is responsible for generating 5% of the country’s capacity. As part of a country-focused series presented by COGEN World and the Advanced Cogeneration and Energy Utilisation Centre of Japan (ACEJ), the potential for cogeneration in Japan has been mapped. Despite the potential, the study made it clear that market growth depends on whether cogeneration makes economic sense and can provide the efficiency and balancing needed for Japan’s grid.

It was after the Fukushima earthquake in 2011 that the Japanese CHP market began to expand, with installations increasing to ensure the availability of stand-alone power during outages. Since then, CHP has found a key role, especially in the industrial sector. Additionally, extreme temperature differences between summer and winter mean that Japan relies on CHP for heating and cooling.

Almost all CHP is driven by gas which saves energy by producing electricity and utilising waste heat, as well as providing much-needed balancing and inertia as renewable generation is increased.

Gas engines are typically the prime mover of the market, with low-carbon fuels and hydrogen, making less of an immediate impact, although they will be considered for future applications.

Japan has about 13GW of operating CHP according to the study with excess generation rarely sold back to the utility, due to technical requirements of grid connection and the power price. The price the utility pays is low making it uneconomic for the generator. More protection relays are also required to prevent power from flowing back to the grid during an outage, which is a complicated and expensive installation. Since overproduction is uneconomic, CHP units are usually smaller and about one-third of peak demand of the facility.

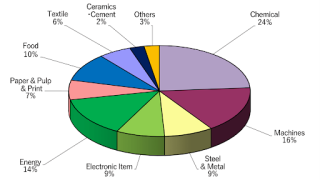

Sectors with high heat demand, particularly the industrial sector, are most suitable for CHP. The industrial sector accounts for almost 11 GW of CHP capacity in Japan, representing close to 85% of the CHP market. The chemicals, machines and energy industries make up most of the CHP industrial applications, representing 54% of the combined industrial applications.

Sectors Number of Installations (unit) Electrical Capacity (MW) Capacity per unit (kW/unit) Chemical Industry 1,082 2,593 2,396 Machine Industry 932 1,792 1,923 Steel & Metal Industry 561 947 1,689 Electronic Item Industry 593 939 1,583 Energy Industry 282 1,534 5,440 Paper & Pulp & Print 383 759 1,983 Food Industry 1,480 1,090 737 Textile Industry 301 632 2,098 Ceramics-Cement Industry 136 280 2,058 Others 369 297 804 Total 6,119 10,863 - CHP Status by Industrial Sector as at March 2023 (source: ACEJ)

![]()

Share of capacity by industrial sector as at March 2023 (source: ACEJ)

According to the ACEJ, in the past, the price of electricity was constant regardless of season, time of day or available supply. However, Japan now operates the Japan Electric Power Exchange which is a a wholesale market where the price of power varies with supply and demand. The balancing market therefore provides ways for producers to increase revenue by using the electricity markets.

However, running CHP during an outage can be complicated, especially without reverse power. The operator of an islanded CHP unit will need to decide what in the facility to prioritise and will need to run the wiring accordingly. Despite these complications, two specific case studies referenced where cogeneration is adding value include the Kiyohara Smart Energy Centre with a 35MW CHP system, consisting of six 6MW gas engines, and the 46 Smart Energy Centre.

Overall, it is thought that CHP will get more important in the move towards carbon neutrality, with around 200MW capacity growth expected each year.