-

Carbon tax could be key policy instrument to enable Asia’s energy transition

Date posted:

-

-

-

Post Author

Greg Kelsall

-

-

![]()

Reducing carbon emissions from Asia and the Pacific is vital, since the region emits half of the world’s carbon dioxide (CO2) emissions. According to a recent study by the International Monetary Fund (IMF), a modest carbon tax of US$25/tCO2, tailored to each country’s energy mix and implemented over a 10-year period, could reduce the region’s greenhouse gas (GHG) emissions by 21%. The IMF report however notes that such a tax would still leave a significant gap compared with the emissions reduction that the International Energy Agency (IEA) has said is needed to limit global warming to 1.5-2.0°C. The study estimates that the carbon tax would have to be US$75/tCO2 by 2030 for the region to be on a trajectory to limit global warming to 1.5°C.

At present, the only countries in the region with carbon taxes are Japan and Singapore, and these are relatively modest at around US$3/tCO2 in Japan and US$4/tCO2 in Singapore. China, Indonesia, Japan, New Zealand, South Korea and Vietnam all have carbon emissions trading programmes.

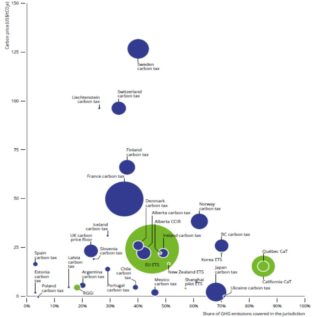

The IMF-modelled carbon fee of US$25/tCO2 is below the value in countries such as Sweden, Switzerland, France, Norway and Lichtenstein, as shown in the World Bank’s Carbon Pricing Dashboard. It would however sit within the range of many European countries, together with Canada, as shown in the figure below based on a 2020 World Bank report.

![]()

Global carbon tax values in 2020 (World Bank)

Whilst political resistance to a carbon tax has been strong in most Asian and Pacific nations, the EU’s move towards imposing border carbon adjustments (BCAs) to levy import fees on goods from countries without carbon taxes or with tax rates deemed too low may provide the impetus for exporting countries to adopt similar measures.

“By imposing their own carbon taxes, countries in the region would reduce, or eliminate, BCAs on their exports and allow them to keep the revenue themselves. And to boost the global mitigation effort and prevent their own mitigation efforts being undermined, the main emitters in Asia and the Pacific should coordinate with other key global emitters to agree on an international carbon price floor” the IMF report recommends.

If the value of carbon in the European Emissions Trading Scheme (ETS) is anything to go by the trend is upwards, with the carbon price exceeding €50/tCO2 equivalent for the first time in May 2021.

![]()

EU ETS carbon market price in Euros (Ember)