-

What’s next for CCS in Europe?

Date posted:

-

-

-

Post Author

Philip SharmanIFRF Director

-

-

![]()

In an IFRF blogpost earlier this month, I reported on the world’s 20th and 21st large-scale carbon capture and storage (CCS) facilities commencing operation in Canada: Carbon dioxide captured at the North West Redwater Partnership (NWR) Sturgeon Refinery and Nutrien’s Redwater Fertilizer Facility is fed into the now operational Alberta Carbon Trunk Line (ACTL) carbon capture, utilisation and storage (CCUS) system.

In that post, I went on to state that while these 21 operating facilities demonstrate good progress with CCS as a low-carbon energy option, the pace of development and deployment of CCS needs to pick-up hugely if we are to see the ~2,000 facilities that the International Energy Agency (IEA) expects to be needed by 2050 to see this “critical technology” fulfil its contribution to meeting climate and energy-related sustainable development goals.

In Europe alone, the European Commission had set, back in 2007, a target of “12 demonstration plants of sustainable fossil fuel technologies in commercial power generation” to be operating by 2015… including the then already existing Sleipner CCS Project (CO2 from two producing gas fields being re-injected into a shallower saline aquifer formation, operational from 1996), only two such plants have been built so far in Europe, the other being the Snøhvit offshore gas facility, both in Norway.

So what is the current state-of-play for new CCS facilities in Europe? In my blogpost of 8th June I mentioned that a further 30 or so other projects are in various stages of development around the world, including in the Netherlands and Norway. Last week, I joined an interesting webinar organised by the Global CCS Institute on ‘Europe’s Next CCS Facilities’, at which Mark Driessen, Manager Public Affairs, Port of Rotterdam, and Trude Sundset, CEO of Gassnova (the Norwegian state enterprise for CCS), presented on the Dutch ‘Porthos Project’ and Norway’s ‘Full Scale CCS Project’ respectively. Both of these projects are approaching the critical ‘financial investment decision’ (FID) point, both are awaiting confirmation of financial support from their respective national governments, both hope to be operational by 2024. So, what are these two projects, what other similarities do they have, and how do they differ from each other?

![]()

The Port of Rotterdam Transport Hub for Offshore Storage – ‘Porthos’ – Project in the Netherlands is a CO2 transport and storage infrastructure project led by three state-owned parties EBN, Gasunie and the Port of Rotterdam Authority, aiming to provide an open-access CO2 transport and storage system serving ‘customers’ in the port area. The Porthos Project comprises a 33km onshore pipeline, a number of dedicated compressor stations, a 20km offshore pipeline and an existing offshore gas platform (‘P18-A’) some 3km above an empty gas field. The project will effectively separate the ‘transport and storage’ from the ‘capture’ elements of CCS, with the CO2 coming from four initial customers, namely Air Liquide, Air Products, ExxonMobil and Shell. The Porthos Project will have the capacity to transport, inject and store 2.5mtpa of CO2, with a total storage capacity of around 37mtCO2. However, Rotterdam is an ideal centre for wider CCS activities, with some 17% of Dutch CO2 emissions originating in the port area – much of it from connected industrial facilities – and with up to 1,600mtCO2 storage in empty offshore gas fields nearby: this could well lead to a greater CCS ‘hub’ linking with other relevant industrial infrastructure including hydrogen production, ‘circular economy’ operations and CO2 utilisation. In the longer term, opportunities could also exist to link the Port of Rotterdam with the Port of Antwerp and the North Sea Port – all large industrial areas with high CO2 emissions – and, as a consequence, an EU ‘Project of Common Interest’ has been established to develop this concept. Separating CO2 capture activities from a transport and storage infrastructure system could create a classic ‘chicken-and-egg’ conundrum – on the one hand who will build such infrastructure without assurance of sufficient CO2 supply to make it viable, on the other hand who will commit to supply CO2 without assurance of sufficient storage being available to take it… The answer, according to Mark Driessen, is a “funnel process” of building up mutual commitments over time. Confidence amongst the three project parties and the four initial customers is already such that the parties are ready to proceed to FID, but subject to financial support being available from the Dutch government. This government support would come from an extension to an existing subsidy scheme (originally designed to support renewable energy projects) soon to include carbon reduction from a wide range of other technology solutions – including CCS. The regulation for this extension is due soon, but the extended scheme, which will aim to close the gap between the CO2 price available within the European Emissions Trading Scheme (ETS) and the total cost of a selected project, will be competitive (based on lowest cost), with no specific ‘allocation’ of funds for CCS versus other technology solutions: Furthermore, all four customers will have to apply separately for government support, with all succeeding if the project is to proceed. The capital expenditure of the Porthos Project is expected to be €400-500 million.

![]()

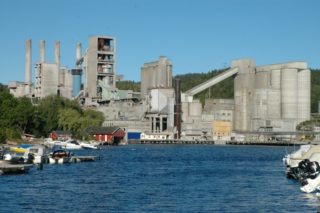

Unlike the Porthos CO2 transport and storage system which, as its name implies, is focused on the transport and storage infrastructure associated with a CCS scheme, the Norwegian ‘Full Scale CCS Project’ is concerned with the whole, integrated CCS value chain. The CO2 capture element will involve two full-scale industrial projects onshore – the Fortum Oslo Varme energy-from-waste facility and Norcem’s Brevik cement manufacturing plant, both located in the Oslo-fjord area in south-eastern Norway. Together, these plants will capture around 800,000tpa of CO2 utilising commercially available post-combustion capture technologies based on amine absorption processes. Owing to the coastal nature of these plants , the geographical separation from potential offshore CO2 storage reservoirs in western Norway and the mountainous terrain in between, the captured CO2 will be compressed and stored initially at the two plants before being shipped in specially-designed liquid-CO2 vessels (together with other, third-party, CO2 in the future) around 700km to a coastal receiving terminal with intermediate storage, near Bergen, from where it will be further compressed, as required, and fed via a 110km pipeline for injection into offshore geological storage sites, at depths of about 3km, in the North Sea. The (ship) transport, intermediate storage and pipeline to offshore long-term geological storage elements of the ‘Full Scale CCS Project’ are referred to as the ‘Northern Lights’ Project and is being developed by private sector energy companies Equinor, Shell and Total in a joint venture. Northern Lights, which has already achieved FID, will have an initial capacity to transport, inject and store up to 1.5mtpa of CO2, however, a ‘phase 2’ project could see this expanded to 5mtpa should there be the market demand for storage and should the joint venture partners decide to invest further. As for the two capture plants, Fortum and Norcem (part of the HeidlebergCement Group) are both said to be ‘FID-ready’, subject to an agreement by the Norwegian government to invest in the project – this decision will be known by the end of the year at the latest, with construction able to start in January and the project fully operational (including Northern Lights) by 2024.

These two proposed new European CCS projects are amongst a group of over 30 projects around the world at various stages of development or construction that, together with the 21 already-operational large-scale CCS facilities worldwide, will boost the combined capture capacity of CCS worldwide to just over 100mtpaCO2. As I stated in the earlier blogpost, this represents a good (if rather slow) start for CCS, but leaves an awful lot to do if CCS is to fulfil its recognised potential.